Listen to the replay of the earnings webcast

General Dynamics Reports Fourth-Quarter 2015 Results

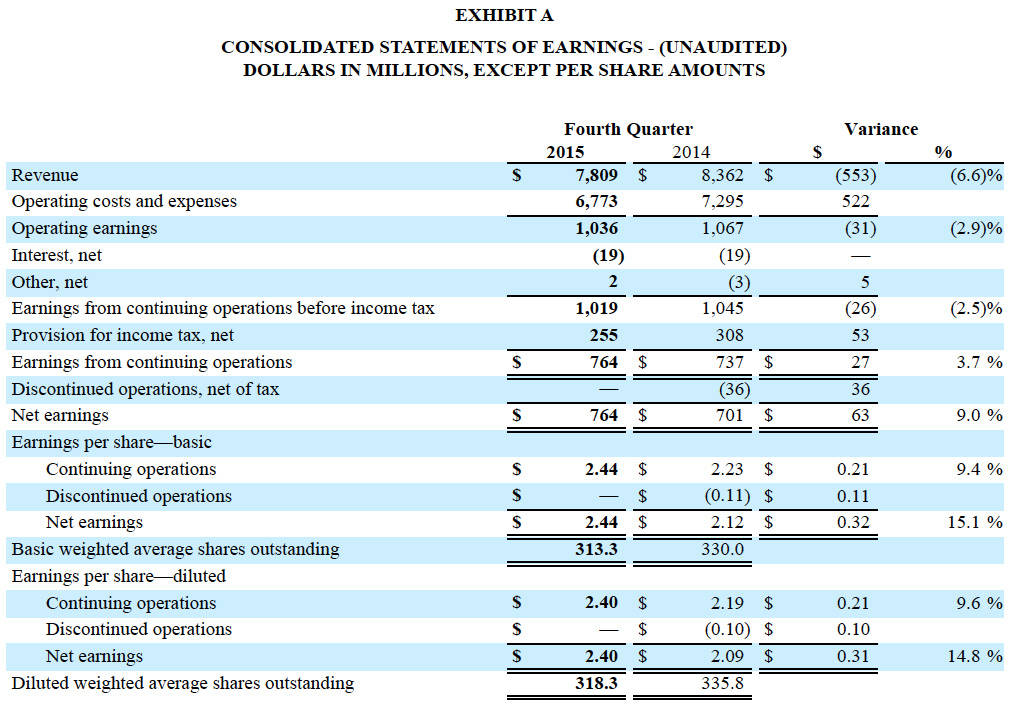

FALLS CHURCH, Va. – General Dynamics (NYSE: GD) today reported fourth-quarter 2015 earnings from continuing operations of $764 million, a 3.7 percent increase over fourth-quarter 2014, on revenue of $7.8 billion. Diluted earnings per share from continuing operations were $2.40 compared to $2.19 in the year-ago quarter, a 9.6 percent increase.

Full-year Results

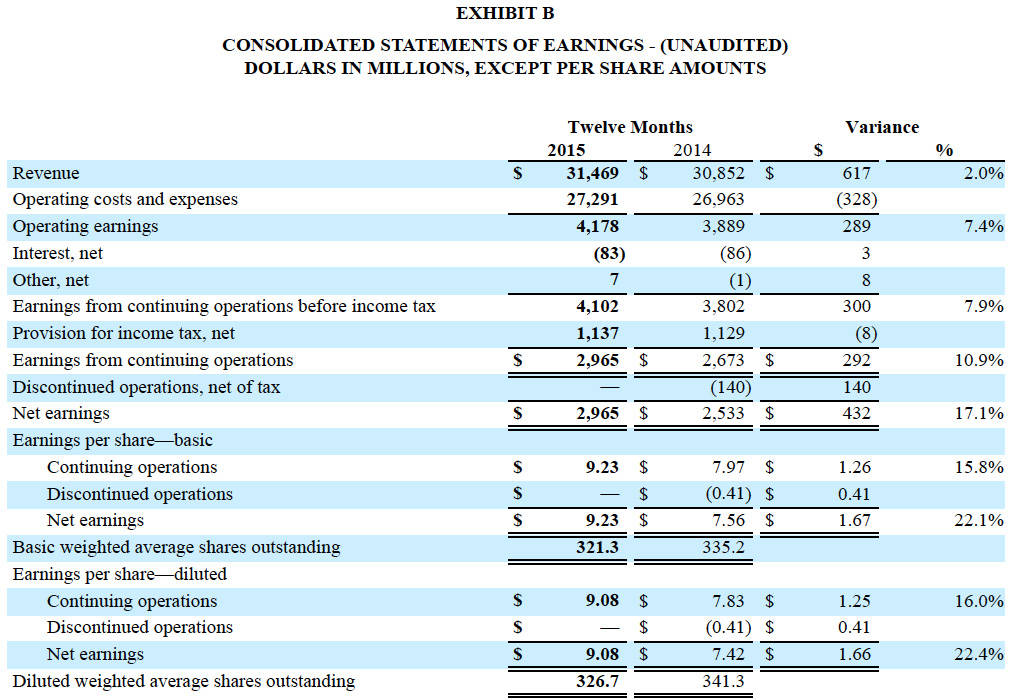

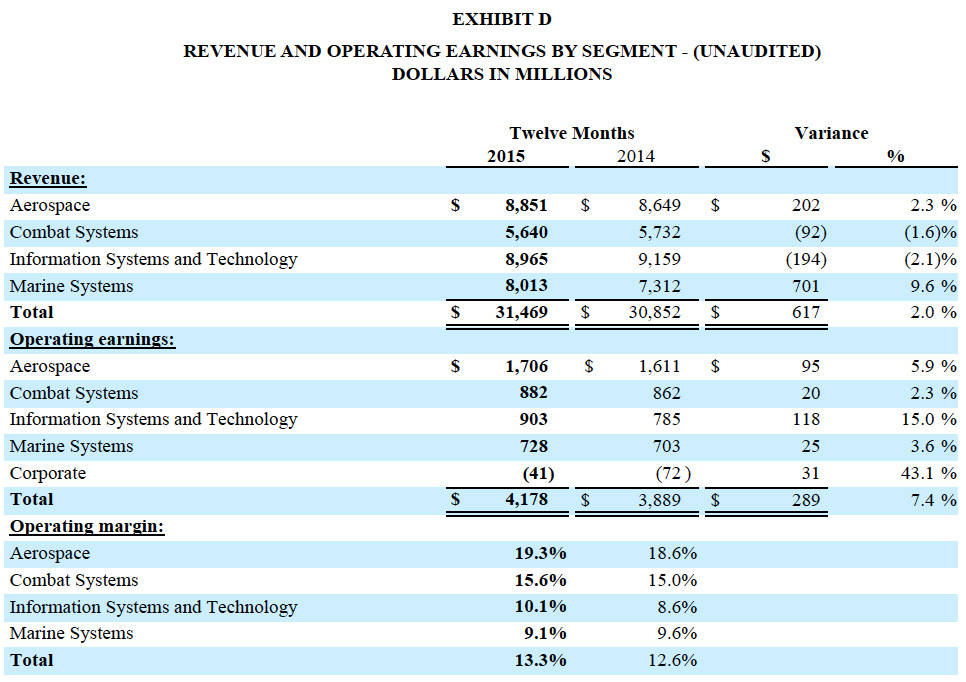

Full-year earnings from continuing operations rose to $3 billion from $2.7 billion in 2014, a 10.9 percent increase. Diluted earnings per share from continuing operations were up 16 percent at $9.08 compared to $7.83 in 2014. Revenue for 2015 was up 2 percent, to $31.5 billion.“General Dynamics had another record-setting year of financial performance, with operating earnings, margins, earnings from continuing operations, EPS and return on sales at the highest levels in the company’s history,” said Phebe Novakovic, chairman and chief executive officer. “We have a healthy and stable backlog with the defense businesses executing on recent program wins, and Aerospace’s backlog is growing year-over-year reflecting strong order activity throughout 2015.

“Over the past 36 months, this management team has demonstrated the value of focusing on operations, managing the business for cash and earnings, and growing return on invested capital. The company’s accomplishments in 2015 illustrate the strength of our approach and support our commitment to disciplined growth.”

Revenue

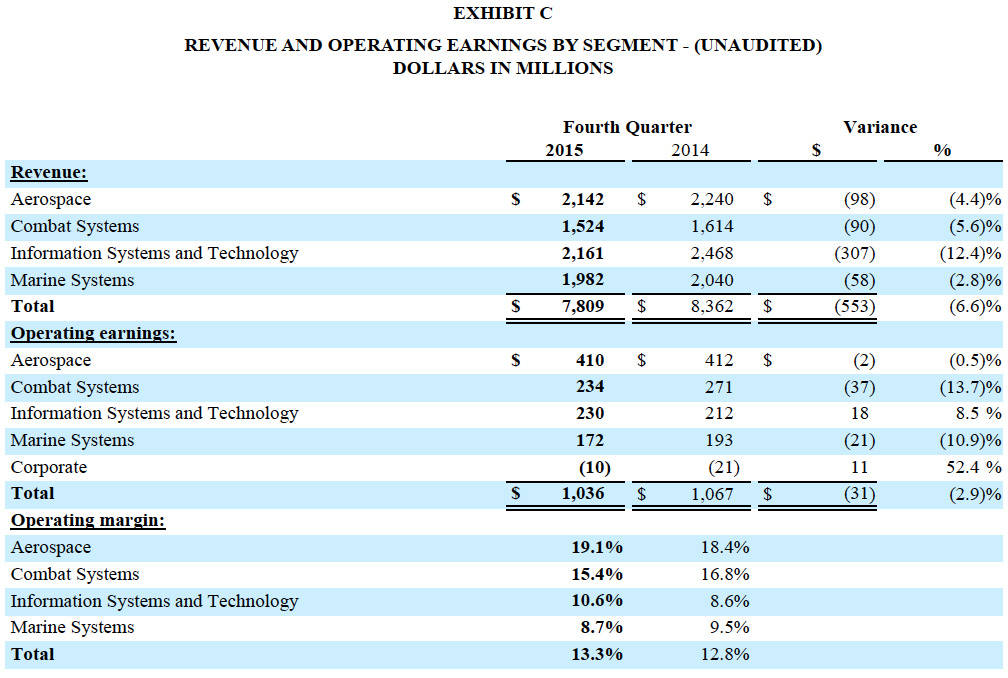

Revenue for the fourth quarter of 2015 was $7.8 billion. For the full year of 2015, revenue was $31.5 billion, a 2 percent increase compared to 2014. The Aerospace and Marine Systems groups increased revenue in 2015, with Marine Systems growing by more than 9 percent.

Margin

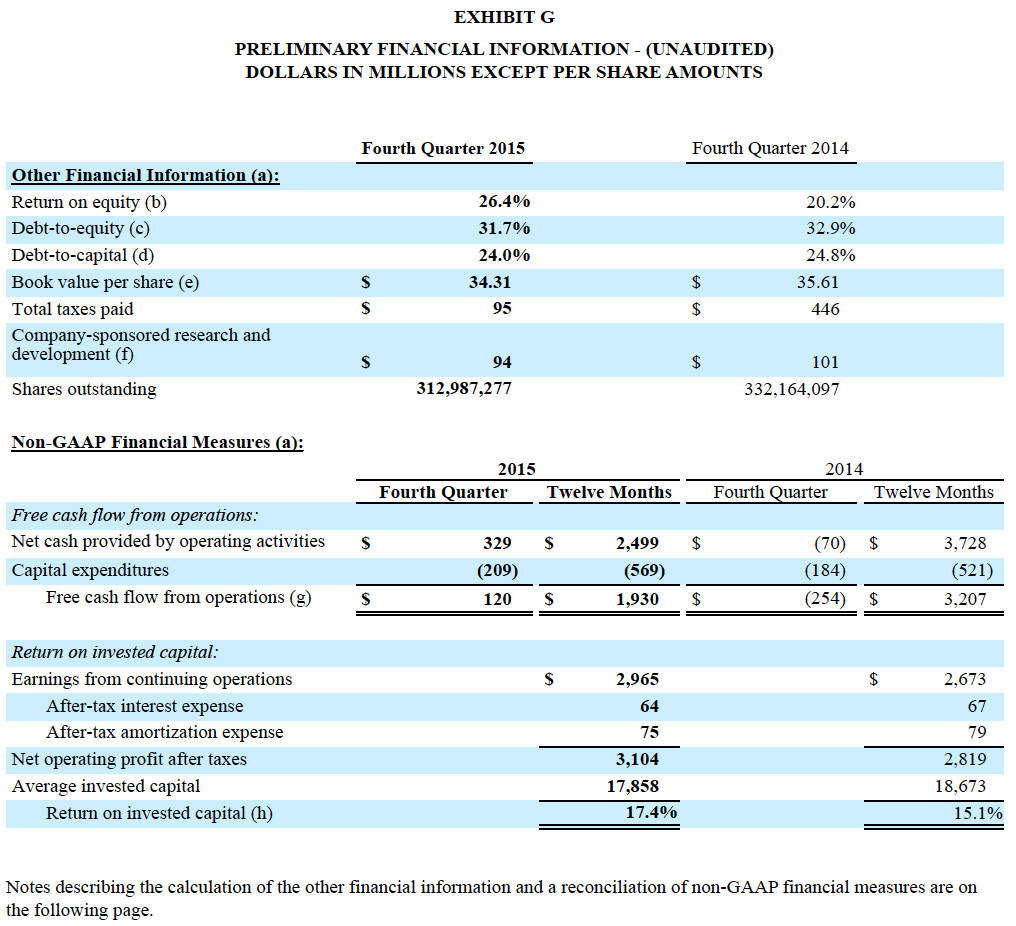

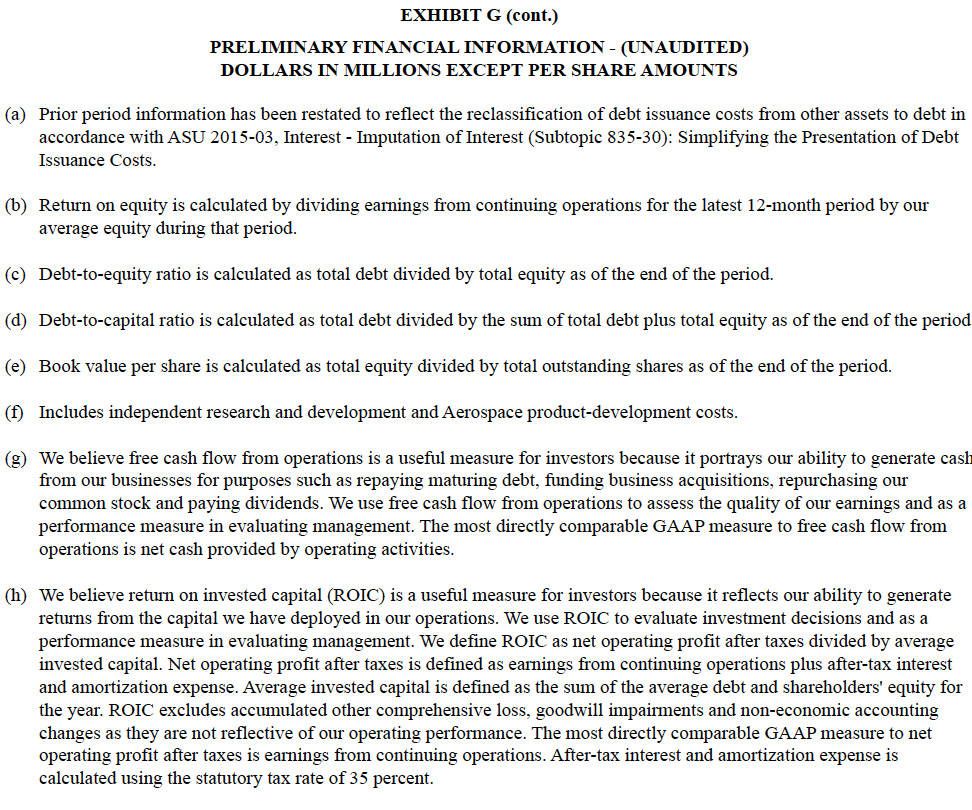

Company-wide operating margin for fourth-quarter and full-year 2015 was 13.3 percent. Margins grew 50 basis points over the fourth quarter of 2014 and 70 basis points for the full year, with expansion in Aerospace, Combat Systems and Information Systems and Technology during the year.

Cash

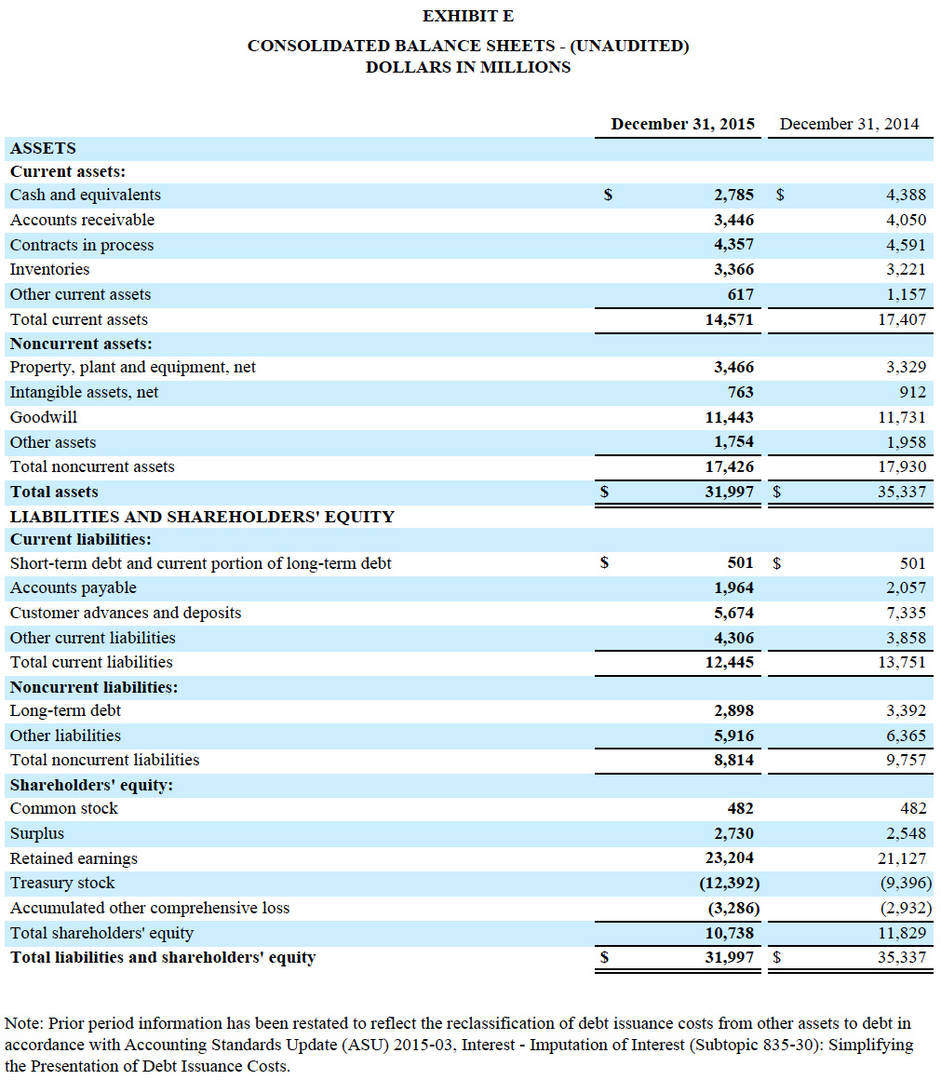

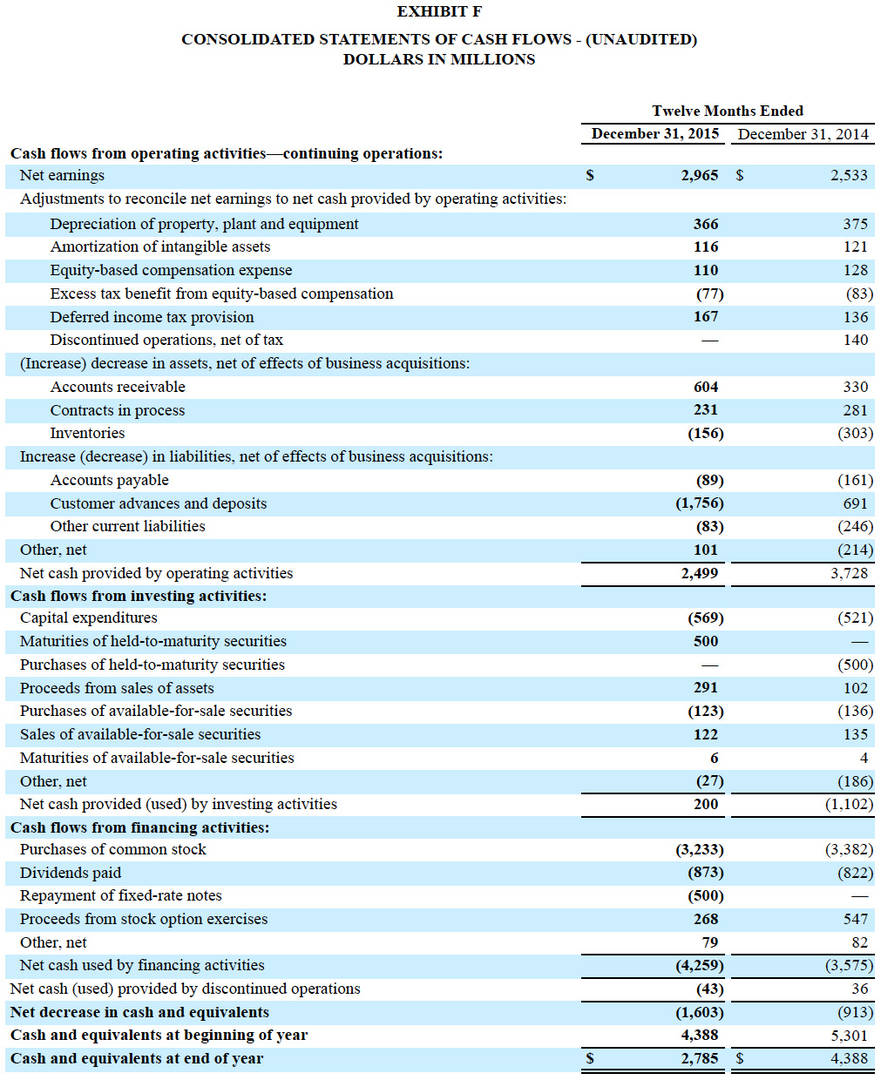

Net cash provided by operating activities for the full year totaled $2.5 billion. Free cash flow from operations, defined as net cash provided by operating activities less capital expenditures, was $1.9 billion for the year.

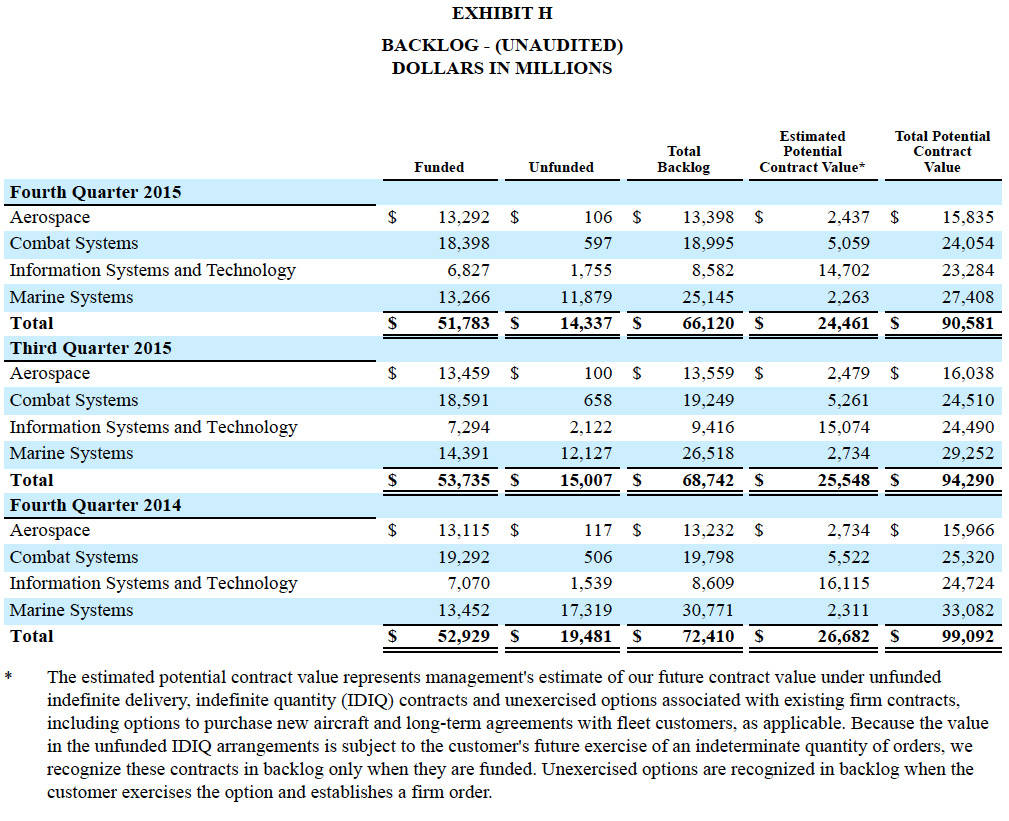

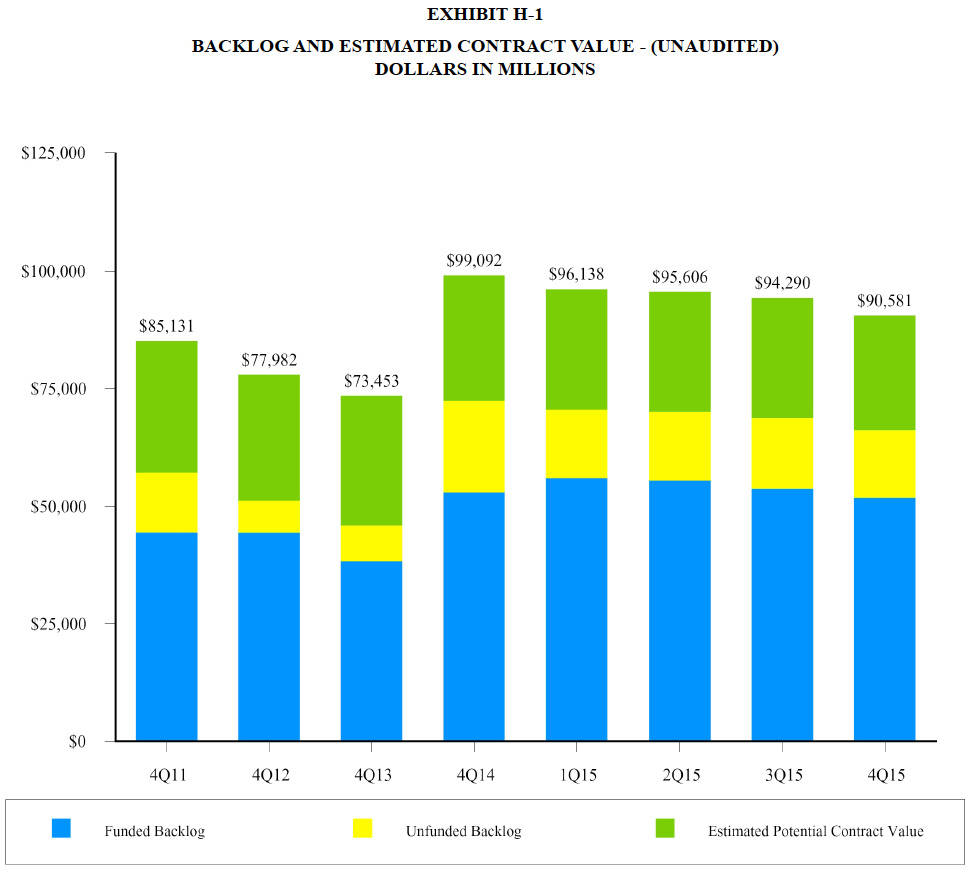

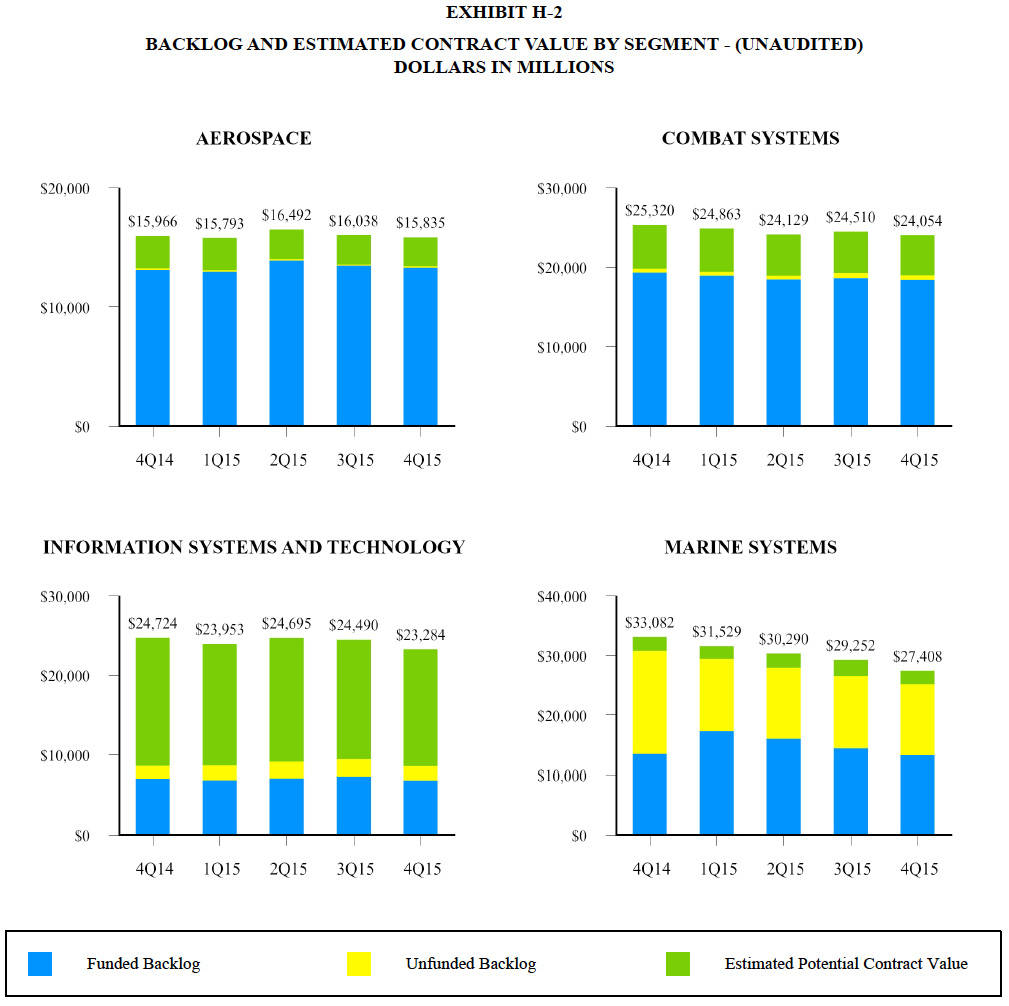

Backlog

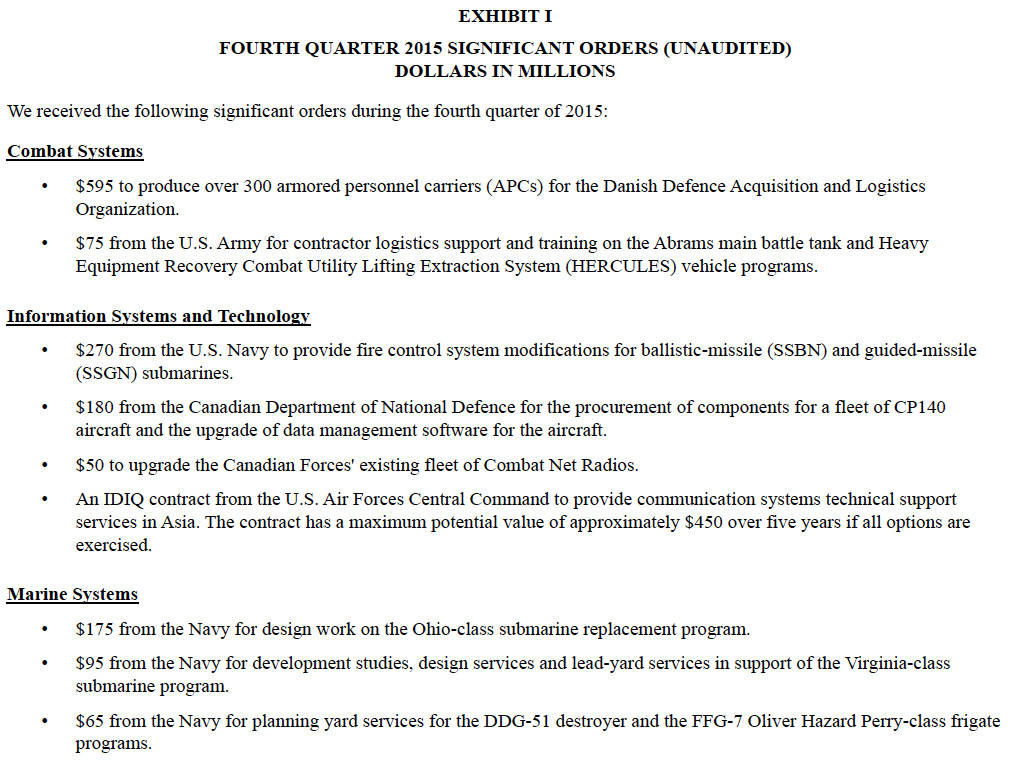

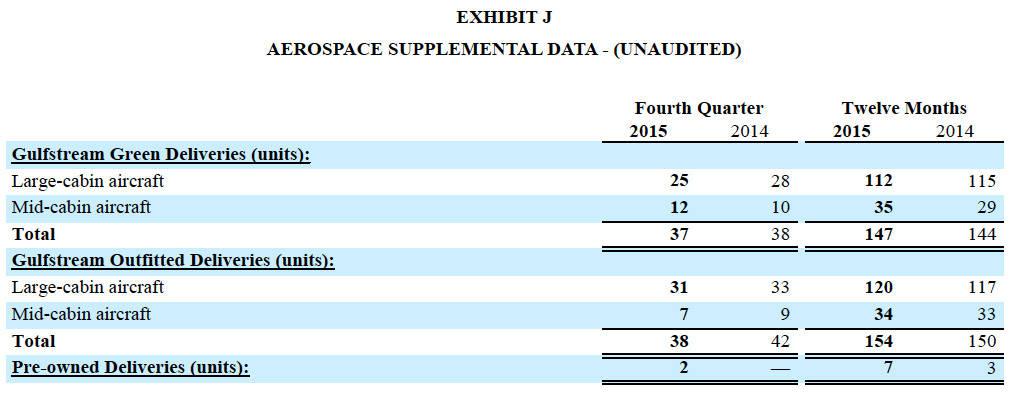

General Dynamics’ total backlog at the end of 2015 was $66.1 billion. It was another strong quarter for the Aerospace group, with order activity in each of the Gulfstream products and across their global market. The estimated potential contract value, representing management’s estimate of value in unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options, was $24.5 billion. Total potential contract value, the sum of all backlog components, was $90.6 billion at the end of the year.

About General Dynamics

Headquartered in Falls Church, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; combat vehicles, weapons systems and munitions; C4ISR and IT solutions; and shipbuilding. More information is available at www.generaldynamics.com.Certain statements made in this press release, including any statements as to future results of operations and financial projections, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company’s filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q.

All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to any forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION:

General Dynamics will webcast its fourth-quarter securities analyst conference call at 11:30 a.m. EST on Wednesday, January 27, 2016. The webcast will be a listen-only audio event, available at www.generaldynamics.com. An on-demand replay of the webcast will be available by 3 p.m. on January 27 and will continue for 12 months. To hear a recording of the conference call by telephone, please call 855-859-2056 (international: 404-537-3406); passcode 22028571. The phone replay will be available from 3 p.m. January 27 through March 3, 2016.

Exhibits