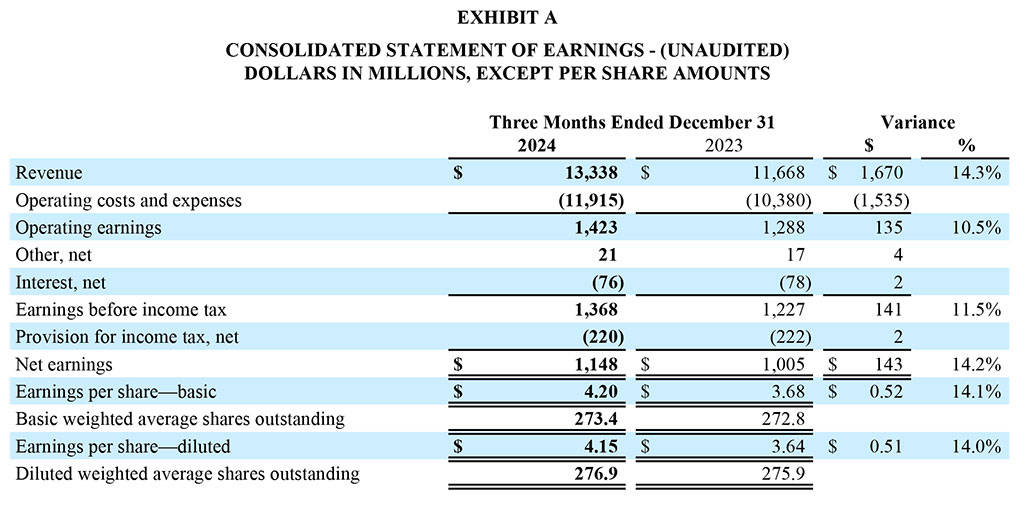

- Fourth-quarter net earnings of $1.1 billion, diluted EPS of $4.15, on $13.3 billion in revenue

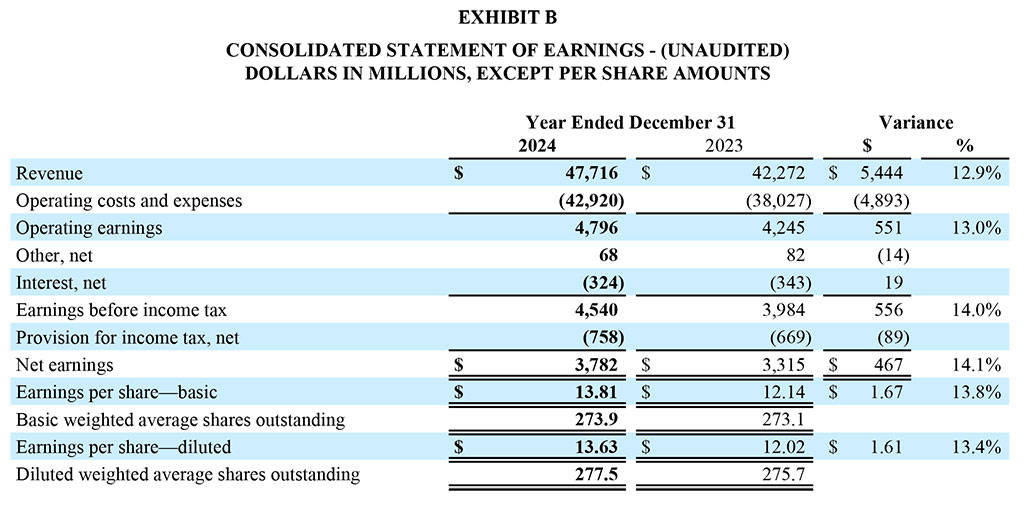

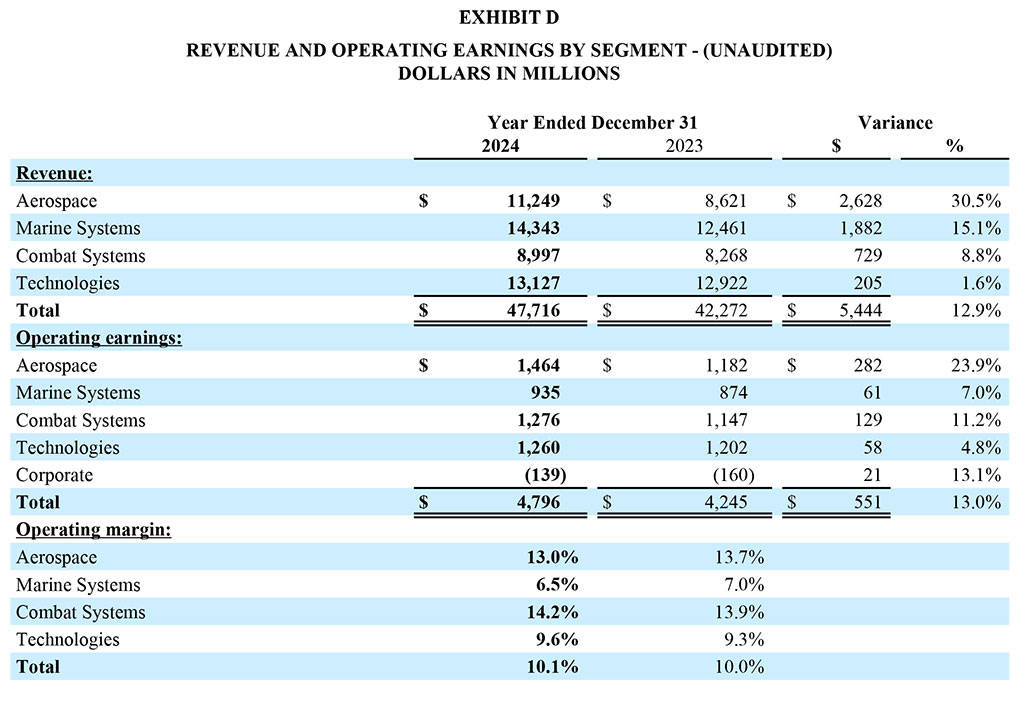

- Full-year net earnings of $3.8 billion, diluted EPS of $13.63, on $47.7 billion in revenue

- $2.2 billion net cash provided by operating activities in the quarter, 188% of net earnings

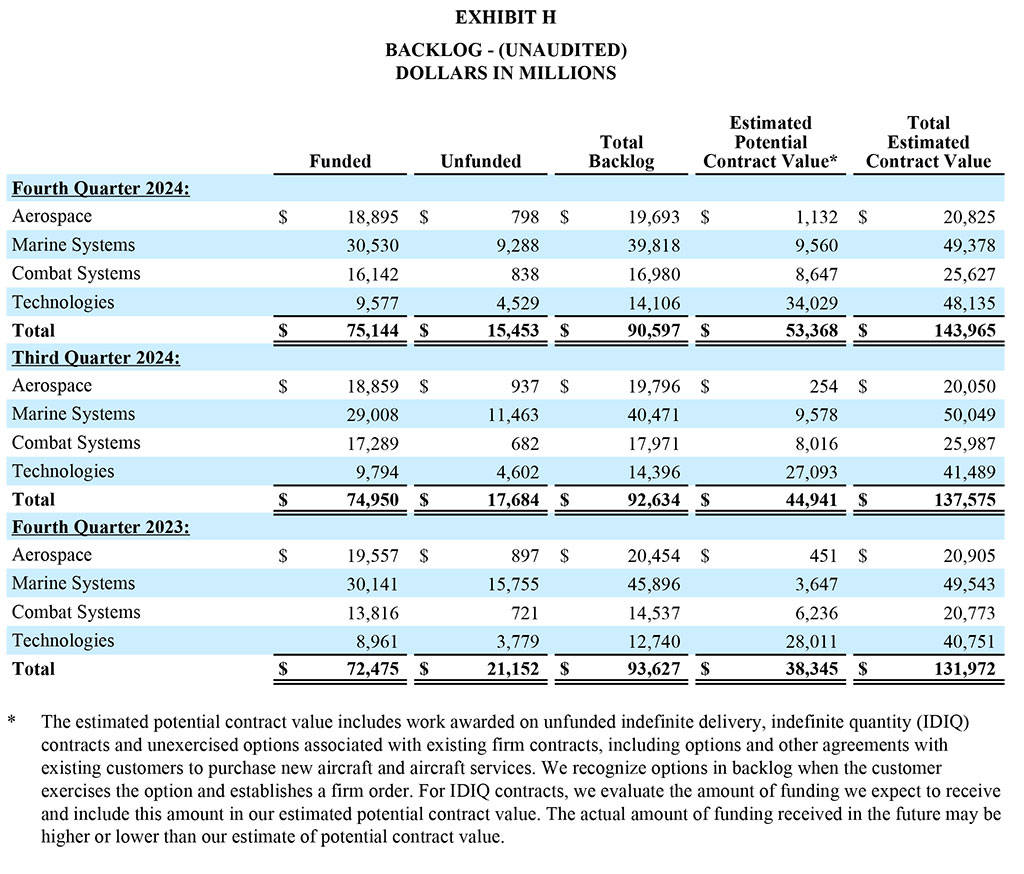

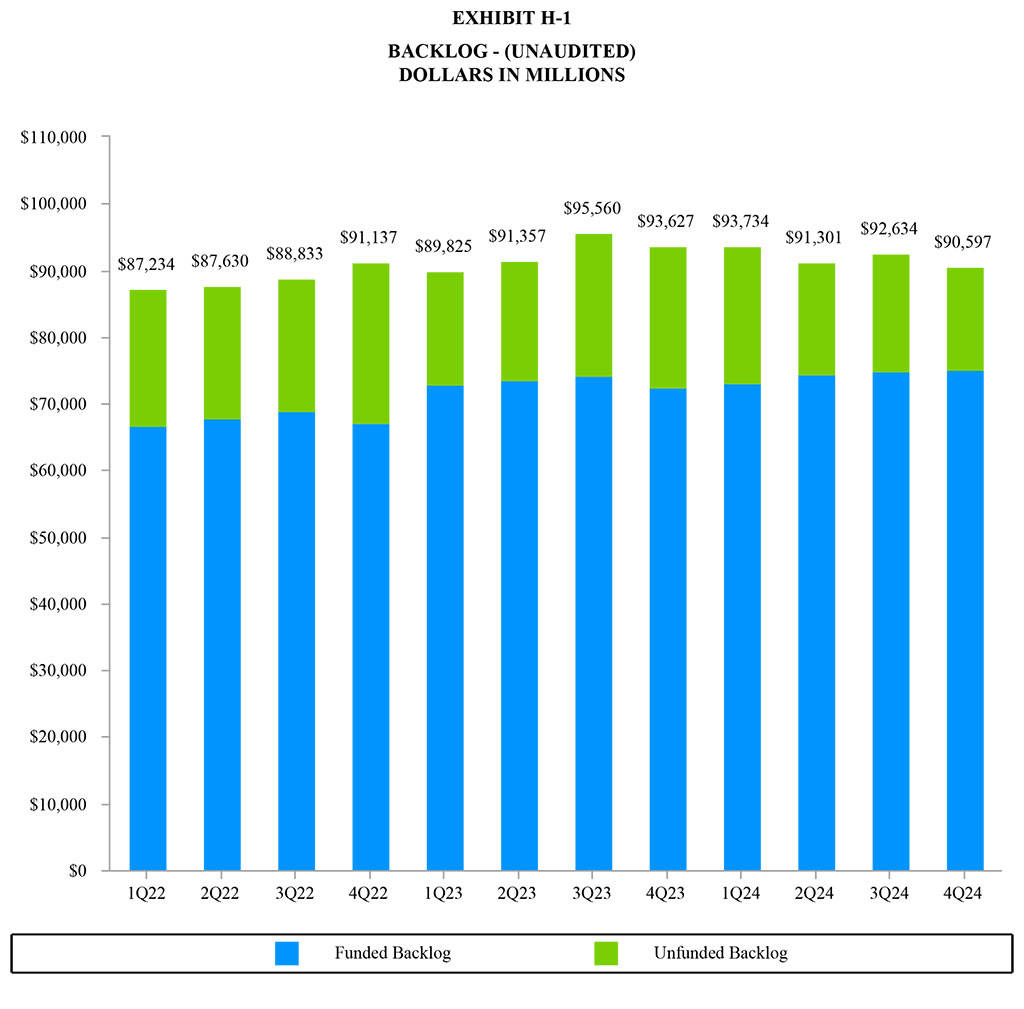

- Ended the year with $90.6 billion in backlog

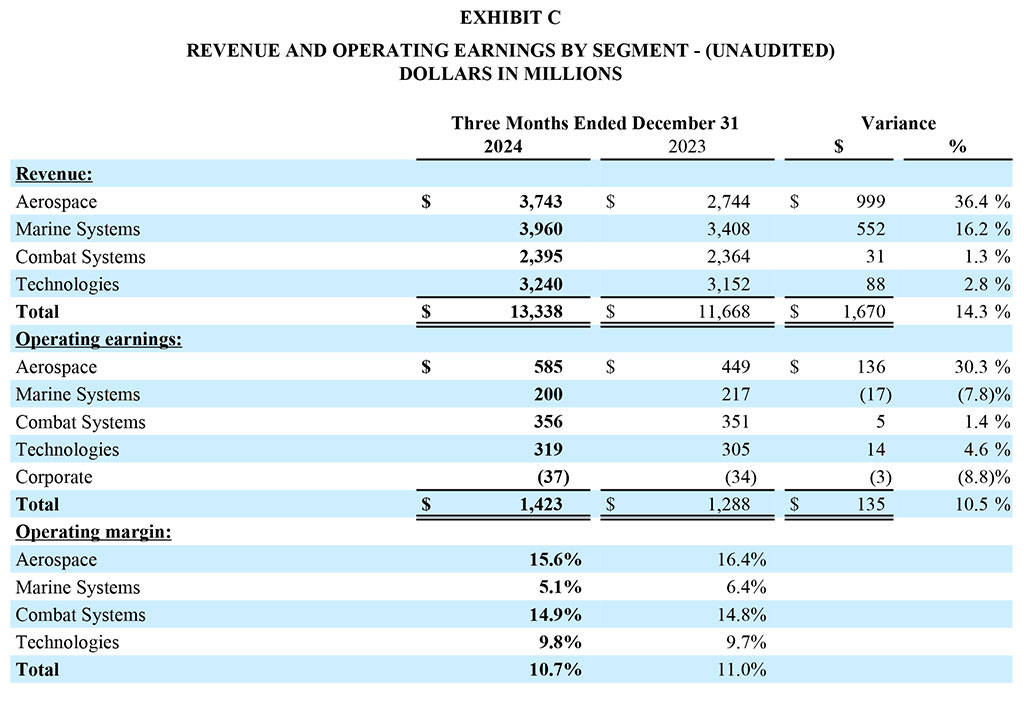

RESTON, Va. – General Dynamics (NYSE: GD) today reported quarterly net earnings of $1.1 billion, up 14.2% from the year-ago quarter, on revenue of $13.3 billion, up 14.3% over the year-ago quarter. Diluted earnings per share (EPS) was $4.15, up 14% from the year-ago quarter.

For the full year, net earnings were $3.8 billion, up 14.1% from 2023, on revenue of $47.7 billion, up 12.9% from 2023. Diluted EPS for the full year was $13.63, up 13.4% from 2023.

“We had a solid fourth quarter, capping off a year that saw steady growth in revenue and earnings across all four segments,” said Phebe N. Novakovic, chairman and chief executive officer. “Order activity continued to be very strong, with 1-to-1 book-to-bill for the year, even as revenue grew by 13%, positioning us well for continued growth.”

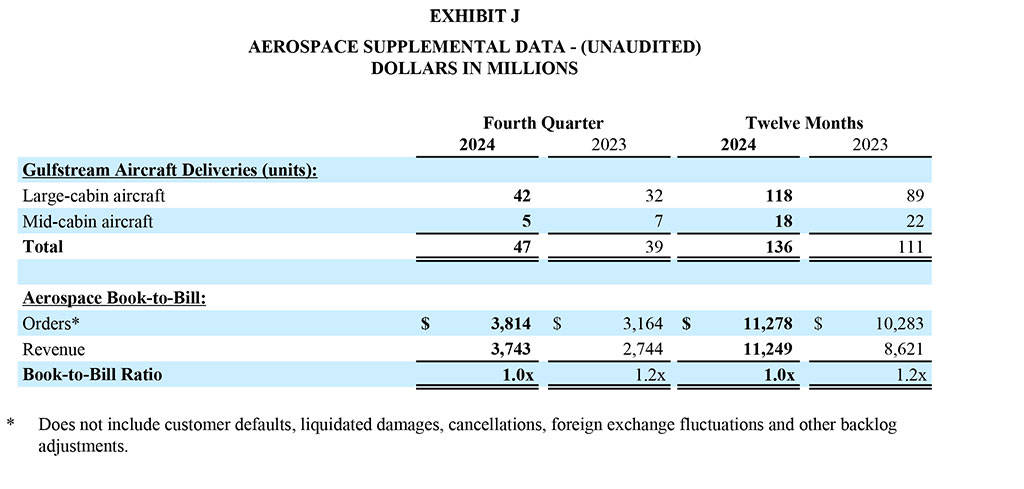

Gulfstream delivered 47 aircraft in the quarter, of which 42 were large-cabin aircraft. The company delivered a total of 136 aircraft during the year, of which 118 were large-cabin aircraft.

Cash

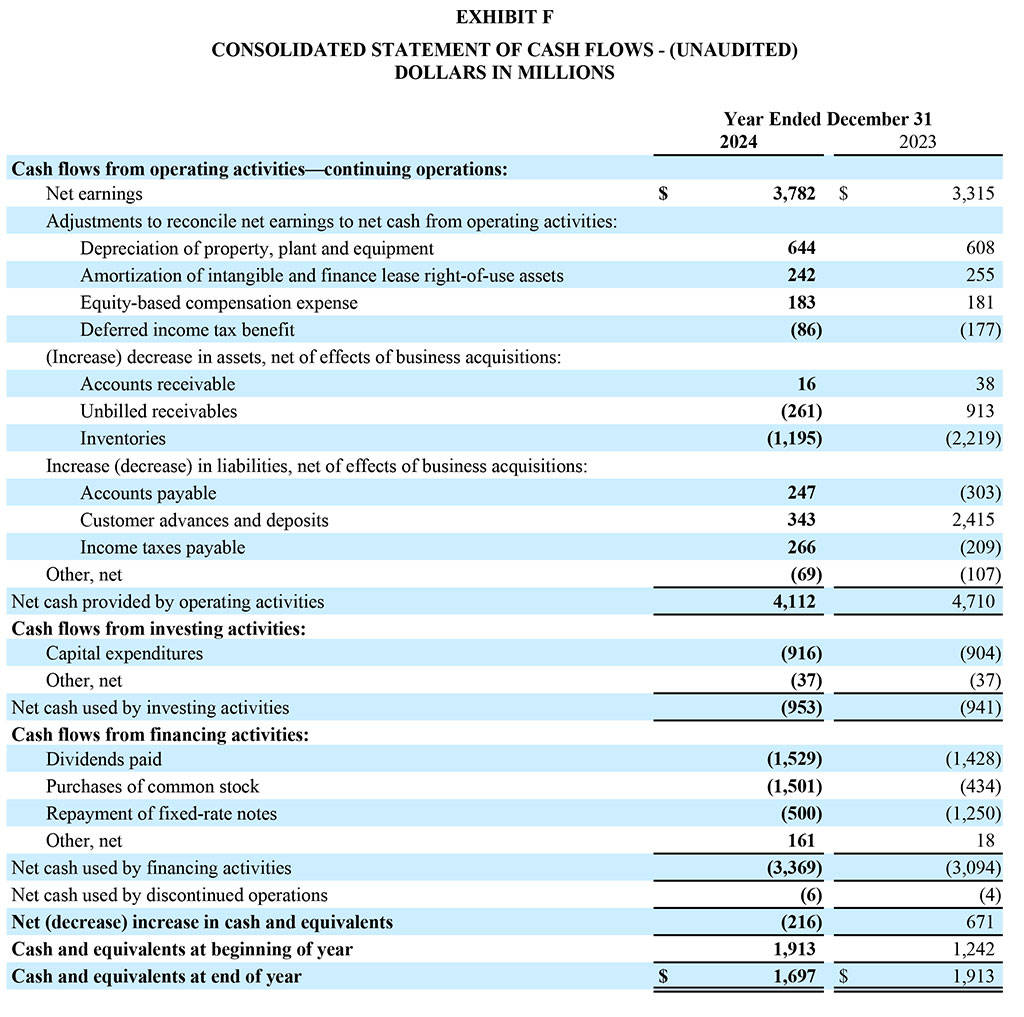

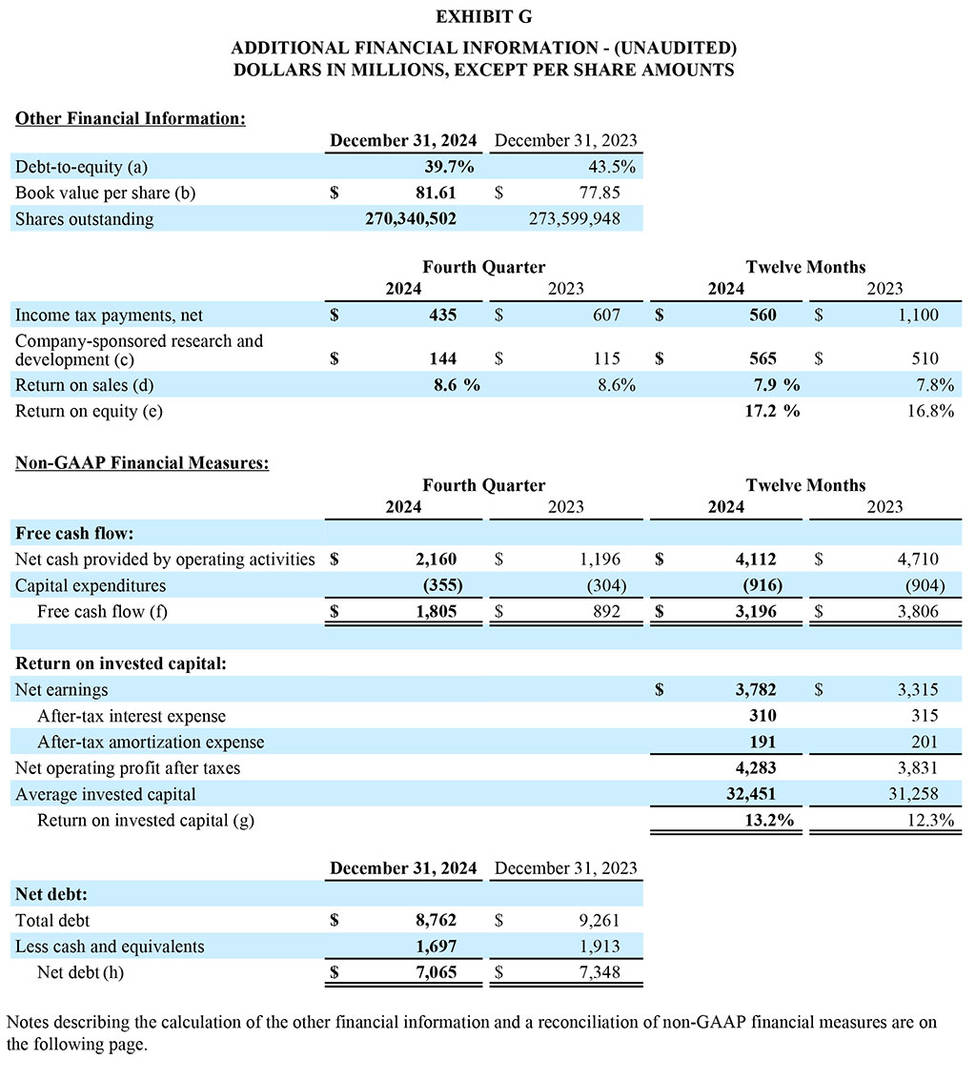

Net cash provided by operating activities in the quarter totaled $2.2 billion, or 188% of net earnings. For the year, net cash provided by operating activities totaled $4.1 billion, or 109% of net earnings.

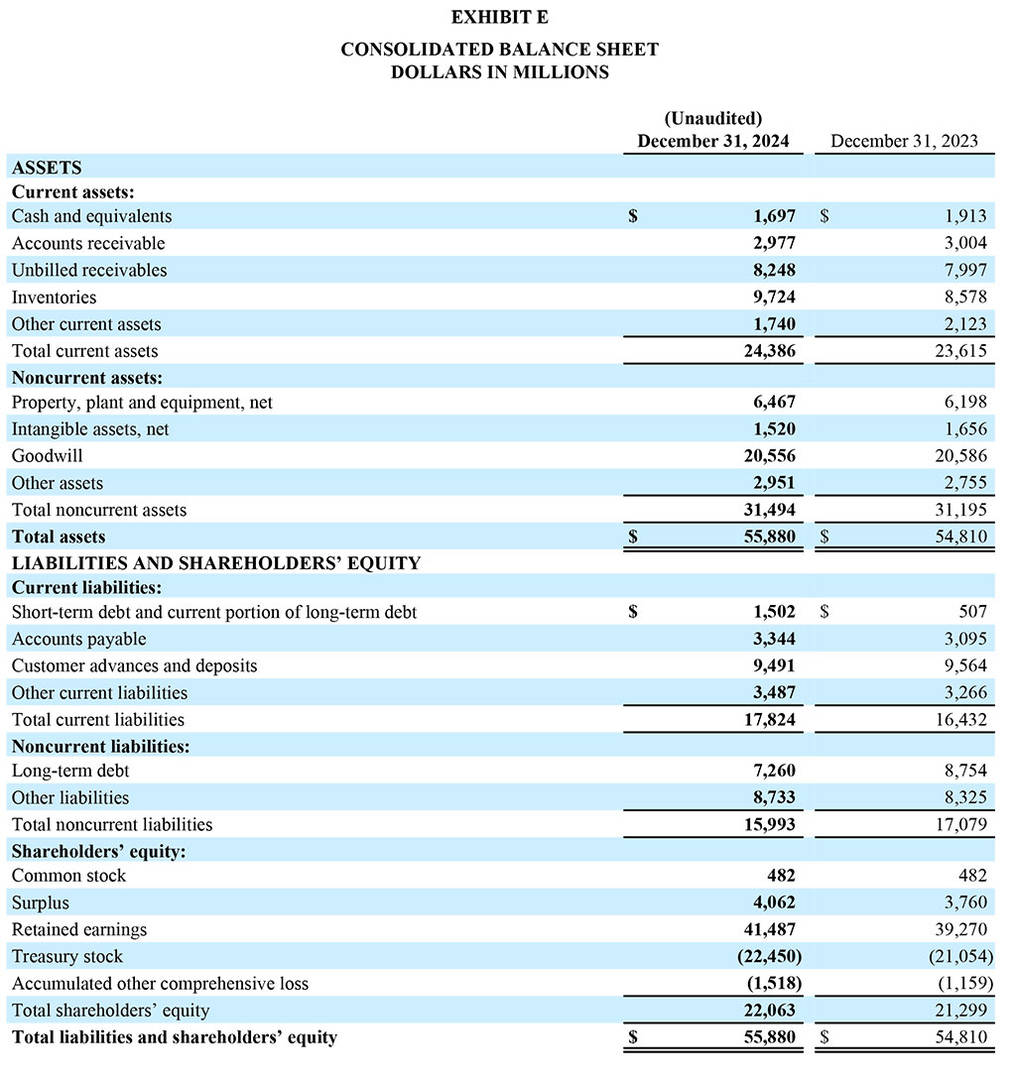

During the year, the company invested $916 million in capital expenditures, made tax payments of $560 million, repaid fixed rate notes of $500 million, and returned $3 billion to shareholders through dividends and share repurchases, ending 2024 with $1.7 billion in cash and equivalents on hand.

Backlog

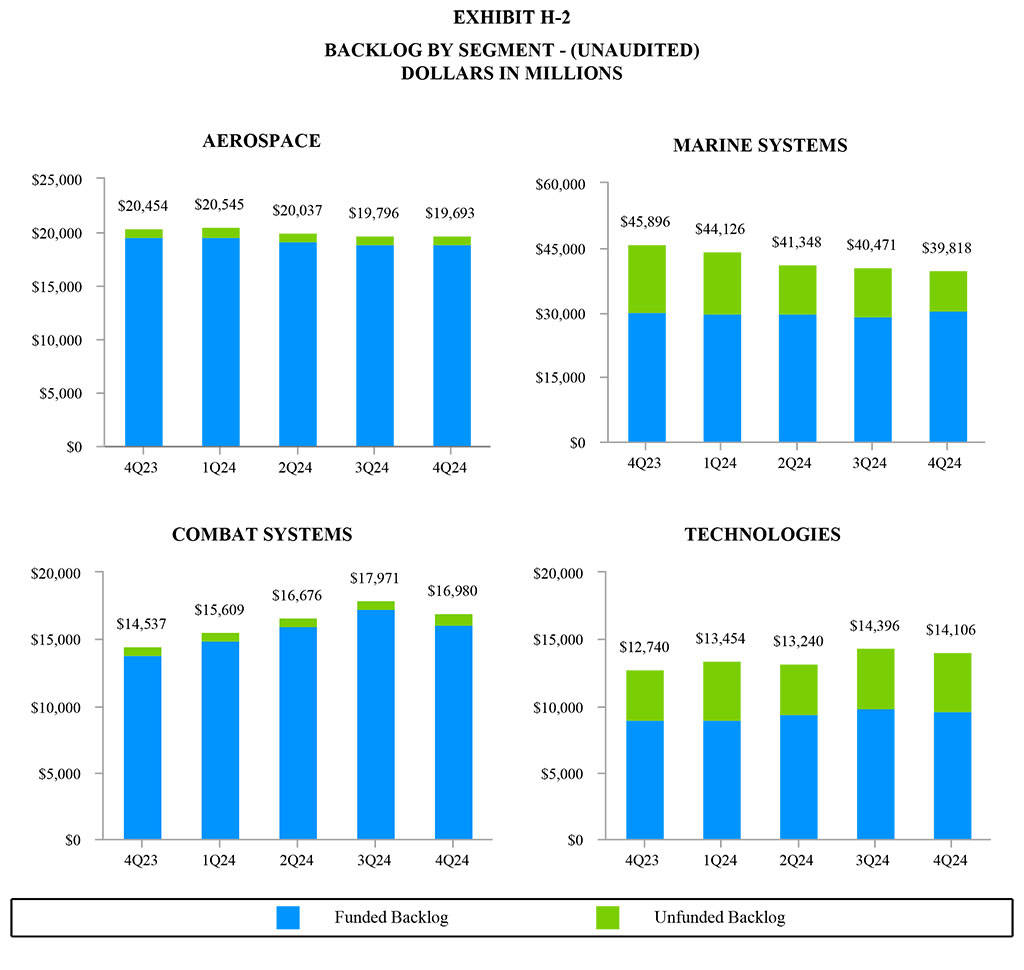

Orders remained strong across the company with a consolidated book-to-bill ratio, defined as orders divided by revenue, of 0.9- to-1 for the quarter and 1-to-1 for the year. The company ended the year with backlog of $90.6 billion and estimated potential contract value, representing management’s estimate of additional value in unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options, of $53.4 billion. Total estimated contract value, the sum of all backlog components, was $144 billion at year end, up 9.1% from a year earlier.

In the Aerospace segment, orders in the quarter totaled $3.8 billion. Backlog at the end of the year was $19.7 billion. Aerospace book-to-bill was 1-to-1 for the quarter and the year.

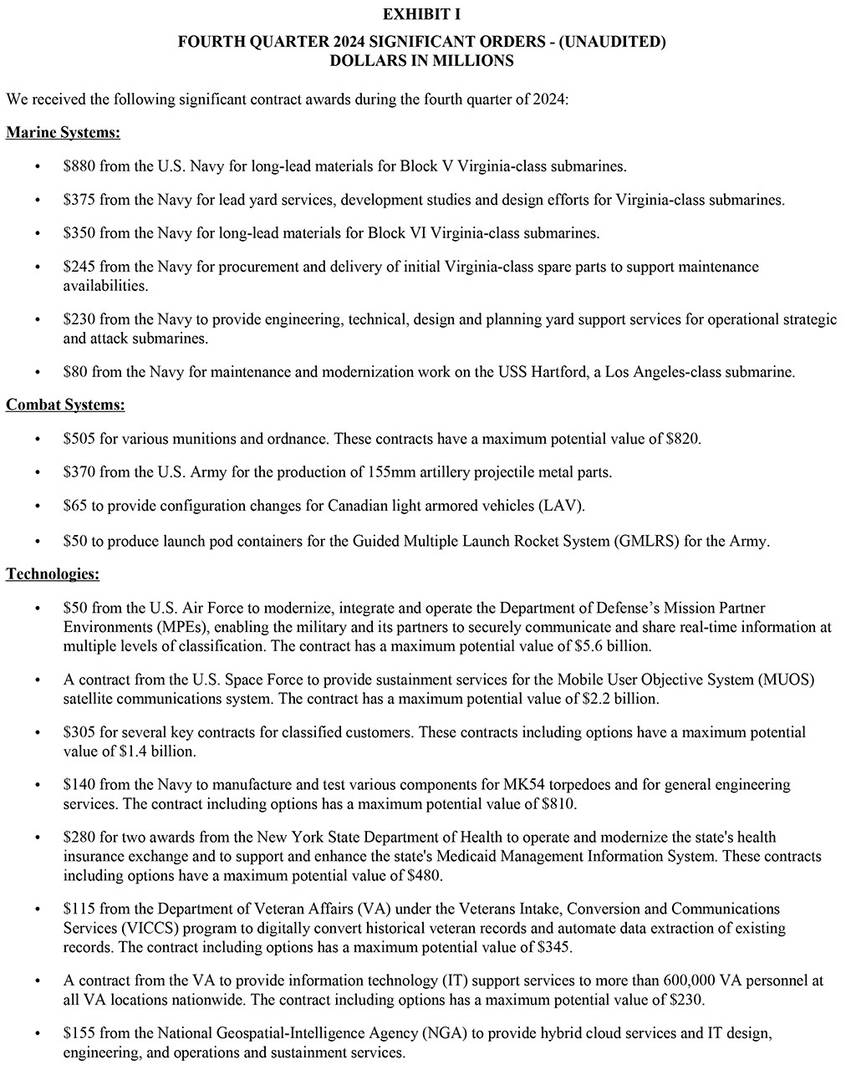

In the three defense segments, significant awards in the quarter include a U.S. Air Force contract with maximum potential value of $5.6 billion to modernize, integrate and operate the Department of Defense’s Mission Partner Environments (MPEs); a U.S. Space Force contract with maximum potential value of $2.2 billion to provide sustainment services for the Mobile User Objective System (MUOS) satellite communications system; $1.9 billion from the U.S. Navy for multiple contracts to provide services, materials and parts for Virginia-class submarines; $370 million from the U.S. Army for the production of 155mm artillery projectile metal parts; contracts for various munitions and ordnance with maximum potential value of $820 million; and several key contracts for classified customers with maximum potential value of $1.4 billion.

About General Dynamics

Headquartered in Reston, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; ship construction and repair; land combat vehicles, weapons systems and munitions; and technology products and services. General Dynamics employs more than 110,000 people worldwide and generated $47.7 billion in revenue in 2024. More information is available at www.gd.com.

WEBCAST INFORMATION: General Dynamics will webcast its fourth-quarter and full-year 2024 financial results conference call today at 9 a.m. EST. The webcast will be a listen-only audio event available at GD.com. An on-demand replay of the webcast will be available by telephone two hours after the end of the call through February 5 at 800-770-2030 (international +1 647-362-9199), conference ID 4299949. Charts furnished to investors and securities analysts in connection with the announcement of financial results are available at GD.com. General Dynamics intends to supplement those charts on its website after its earnings call today to include information about 2025 guidance presented during the call.

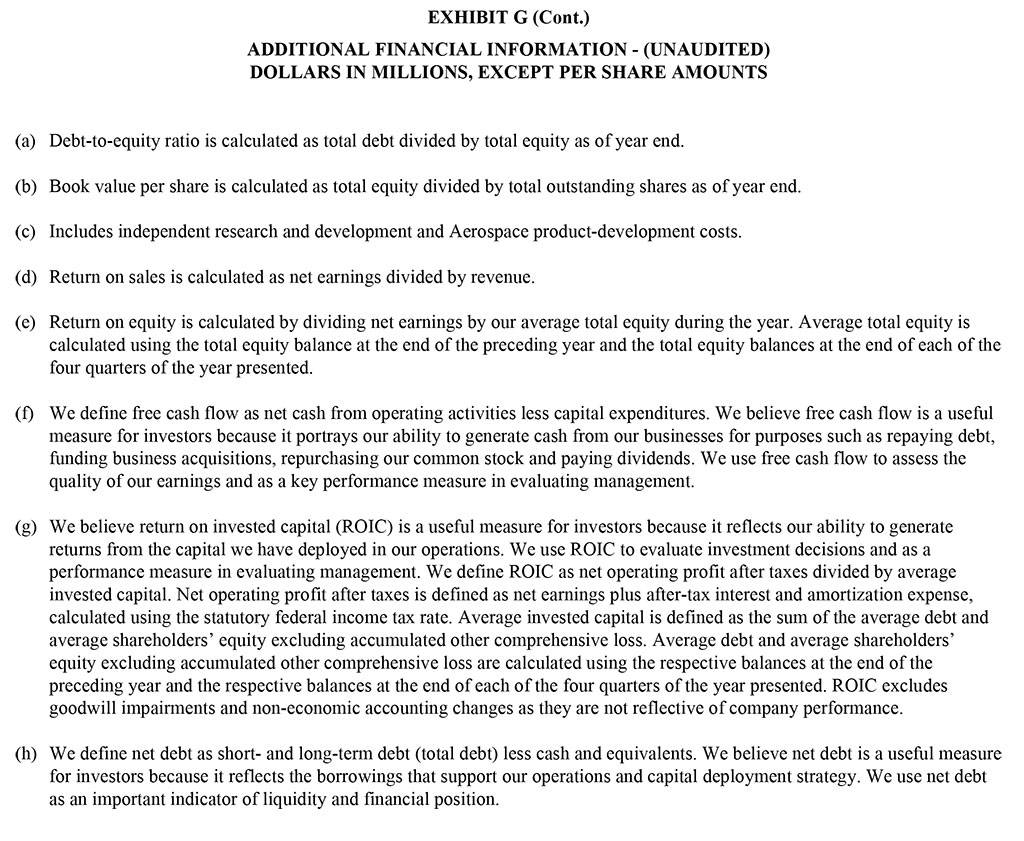

This press release contains forward-looking statements (FLS), including statements about the company’s future operational and financial performance, which are based on management’s expectations, estimates, projections and assumptions. Words such as “expects,” “anticipates,” “plans,” “believes,” “forecasts,” “scheduled,” “outlook,” “estimates,” “should” and variations of these words and similar expressions are intended to identify FLS. In making FLS, we rely on assumptions and analyses based on our experience and perception of historical trends; current conditions and expected future developments; and other factors, estimates and judgments we consider reasonable and appropriate based on information available to us at the time. FLS are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. FLS are not guarantees of future performance and involve factors, risks and uncertainties that are difficult to predict. Actual future results and trends may differ materially from what is forecast in the FLS. All FLS speak only as of the date they were made. We do not undertake any obligation to update or publicly release revisions to FLS to reflect events, circumstances or changes in expectations after the date of this press release. Additional information regarding these factors is contained in the company’s – more – filings with the SEC, and these factors may be revised or supplemented in future SEC filings. In addition, this press release contains some financial measures not prepared in accordance with U.S. generally accepted accounting principles (GAAP). While we believe these non-GAAP metrics provide useful information for investors, there are limitations associated with their use, and our calculations of these metrics may not be comparable to similarly titled measures of other companies. Non-GAAP metrics should not be considered in isolation from, or as a substitute for, GAAP measures. Reconciliations to comparable GAAP measures and other information relating to our non-GAAP measures are included in other filings with the SEC, which are available at investorrelations.gd.com.